Ascending Triangle Pattern Forex Swing Trading Strategy

The ascending triangle pattern system is an explosive chart pattern that can give you a lot of profits if you know the system.

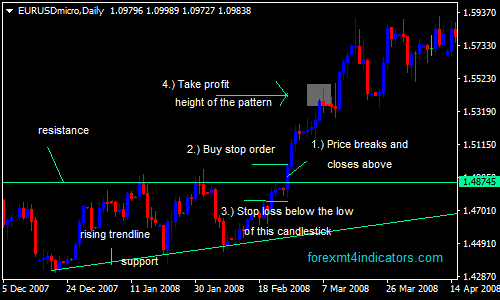

This system forms when two converging trendlines which are the support levels & resistance levels converge to form an apex point.

This method is considered to be a bullish formation and it forms when the market is in an uptrend and serves as a continuation pattern. This is confirmed by a price breakout and closes above the resistance of the ascending triangle. It is considered as a reversal pattern if the price breaks to the downside.

To identify an ascending triangle pattern, the market has to be in an uptrend and slows down to consolidate and hits resistance level. The price then falls and find support on a rising trendline. The price gets squeezed into a tight spot and then breaks.

The clues are the upper horizontal resistance line & the rising support trendlines.

Trading Rules:

- The price must break and close above the resistance line.

- Place a buy stop order 3-5 pips above the high of that breakout candlestick.

- Place your stop loss. below the support line or the halfway point between the resistance and the support line. Another option is to place it 5-30 pips below the low of the breakout candlestick.

- To take profit, it should be 3 times the amount of what you risked in pips or measure the height of the pattern.

ADVANTAGES:

- It is reliable in a strong uptrend market.

- Purely price action strategy, no need for other indicators.

- Easy to identify trade setup

- Large profits can be taken on a higher timeframe from 1-hour and above.

DISADVANTAGES:

- Stop loss can be large on a larger timeframe.

Open EURUSD for template purposes.