Arrows Trend Flow Forex Trading Strategy

“Water seeks its own level.” We’ve heard this metaphor time and time again. Of course, water would always flow to the lowest level. But the same principle taken from hydrostatics would also apply with trading. You see, trading is all about price and how it moves. The same price is also dependent on the collective bias of all the market participants, how they think price should be and where they think it is going. In other words, price seeks the area of least resistance. If the market generally thinks that price is going down, there is a greater probability that price would go down. If the market thinks price is going up, then chances are price would be going up.

With this thought in mind, how should we trade? Should we be fighting against the current, trying to swim upstream or should we just go with the flow? While there is a place for countertrend trading, generally, trading with the trend tends to have a higher probability of success. The question is how do we determine where price is flowing to?

Three Moving Averages – The Compass Used by Many

There are three moving averages that are commonly used by many traders to determine trend, the 50, 100 and 200-period moving averages. Some use it all together while others use just one or two of these. Traders also differ with regards to the type of moving average used. Some prefer the simple moving average, others use a linear weighted moving average, while some also prefer the exponential moving average. Each one has its pros and cons but it all boils down to which one works best for you. The magic though is in the number. Because these are common round numbers, many traders gravitate towards using these parameters, and because many traders use it, it tends to work better than moving averages that only a few traders look at. There are some other common short-term moving averages that traders look at, but these seem to be one of the most popular mid-to-long-term moving averages.

How do traders use it? Some use it as a measure of how expensive or cheap price is based on how far price is from these moving averages, others determine trend by identifying where price is in relation to the moving average, some also determine trend based on how these moving averages are stacked. There are many variations of how moving averages could be used to determine trend direction. The key is to try to be in sync with what most traders are thinking.

Trading Strategy Concept

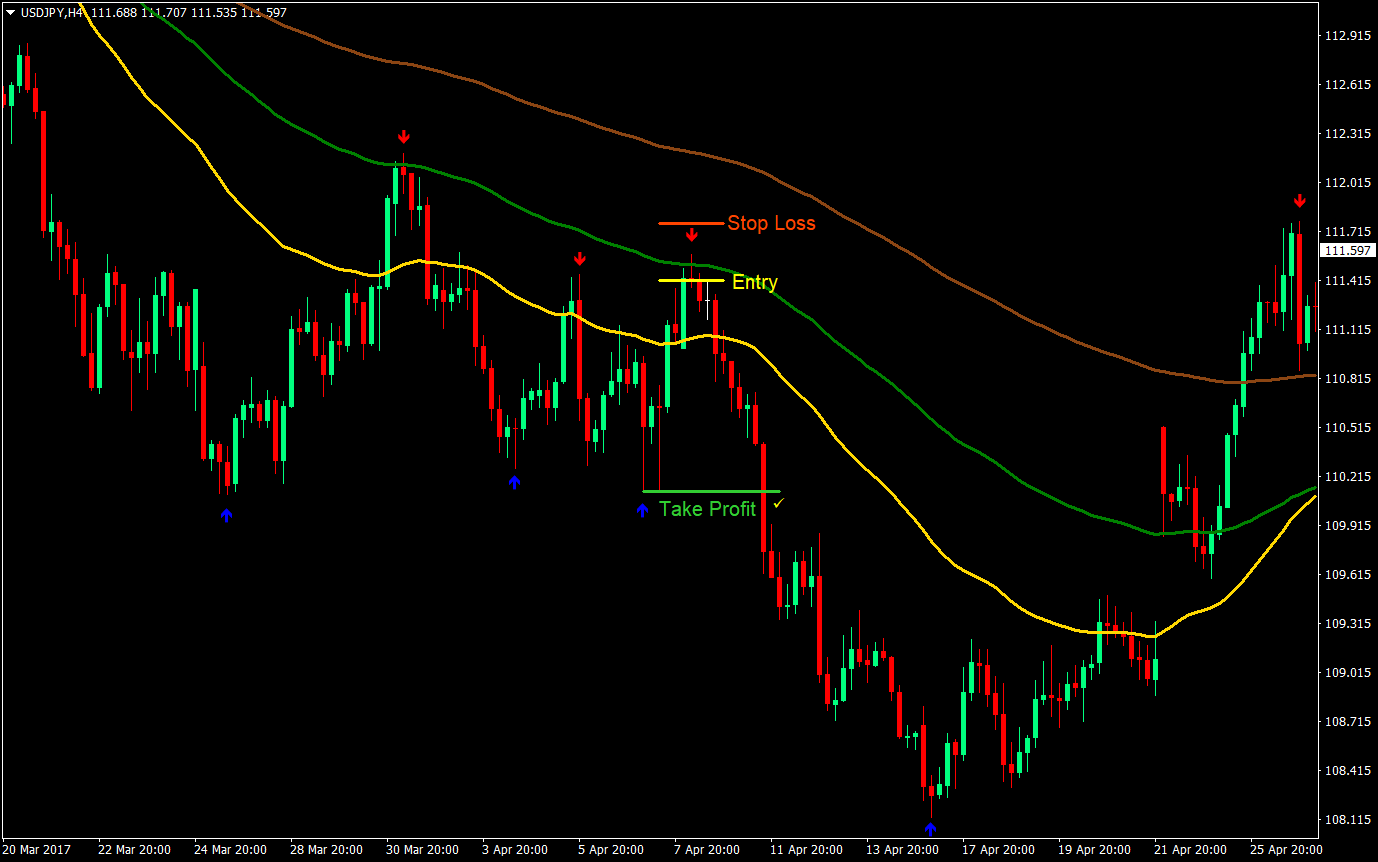

Coming from the idea of determining trend direction based on whether the three moving averages are in agreement, we will be basing our trend direction on how the three moving averages are stacked. On a long-term uptrend, the shortest moving average is generally on top while the longest moving average is usually at the bottom. On a downtrend, the moving averages stack gets inversed. We will also be using Exponential Moving Averages (EMA).

After determining trend and trade direction, we will be identifying the entry. To determine the entry, we will be using the binaryarrows custom indicator. This indicator conveniently prints an arrow when it determines that price could be reversing at a certain candle. However, we won’t be taking every arrow that appears. For higher probabilities and better results, we will only be taking candlesticks with long wicks or pin bar candle stick patterns.

Pin bar candlesticks is a pattern that many traders look for as a confirmation of a reversal. This is because a pin bar is an indication of a sudden shift in sentiment. Within one period represented by a candle, price changed immediately changed direction. Long wicks also generally signify price rejection. It could be that the as soon as price reached a certain level, market participants immediately recognized that price could be too low or too high and traded accordingly. Lastly, having many traders using this pattern as a part of their trade setup only increases the probability of a successful trade.

Indicators:

- 50 EMA (gold)

- 100 EMA (green)

- 200 EMA (brown)

- binaryarrows

Timeframe: any

Currency Pair: any

Trading Session: any

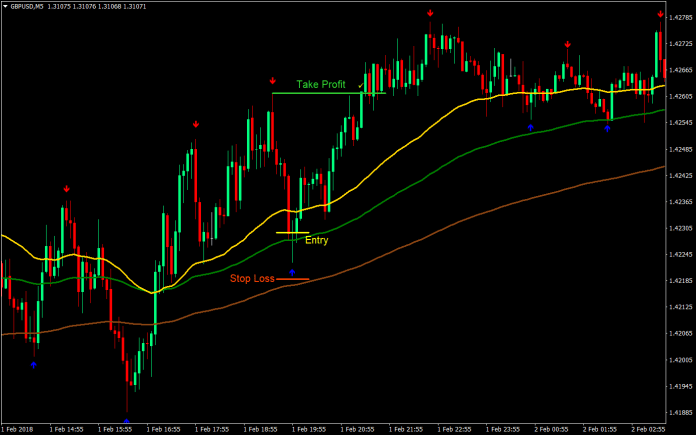

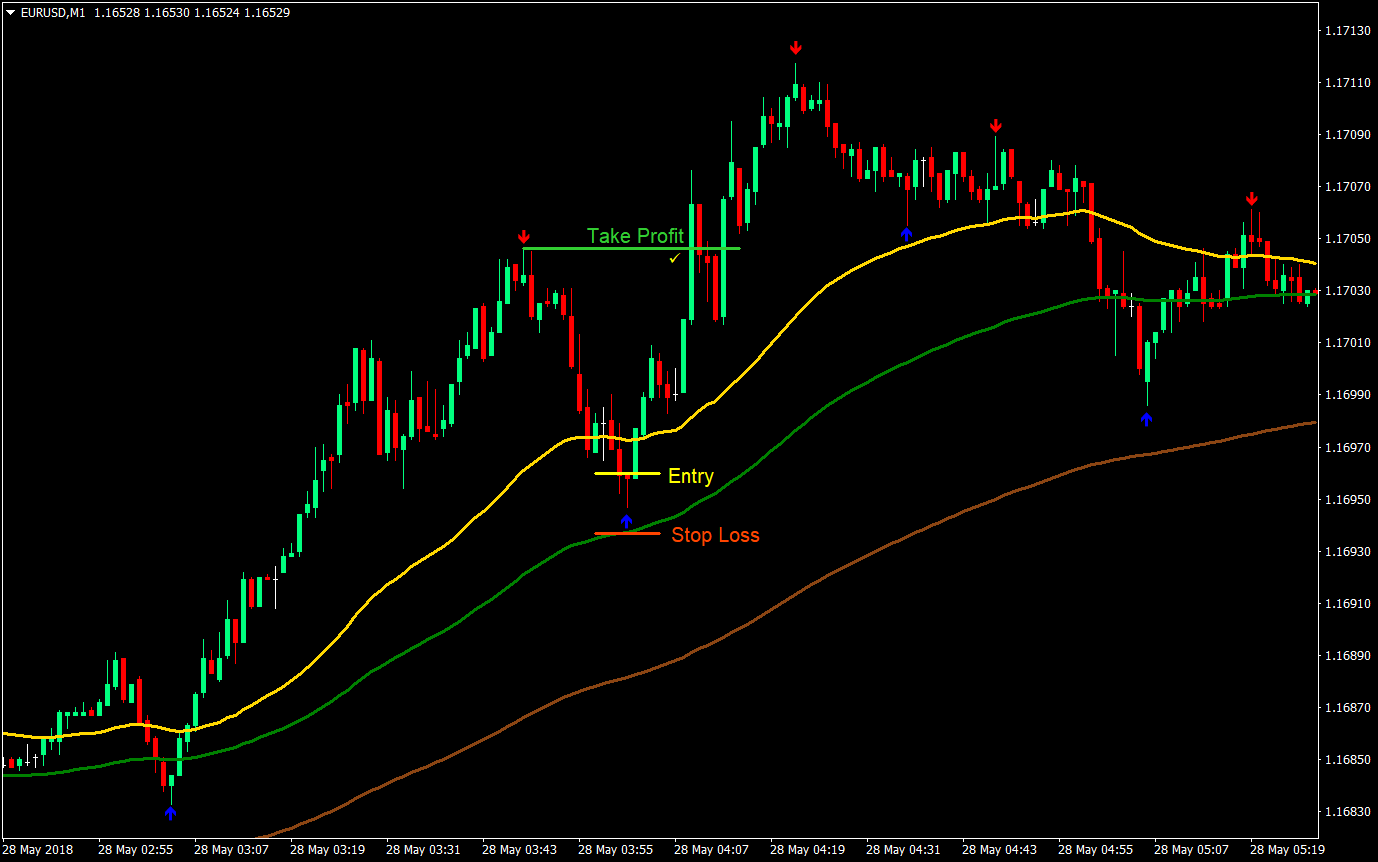

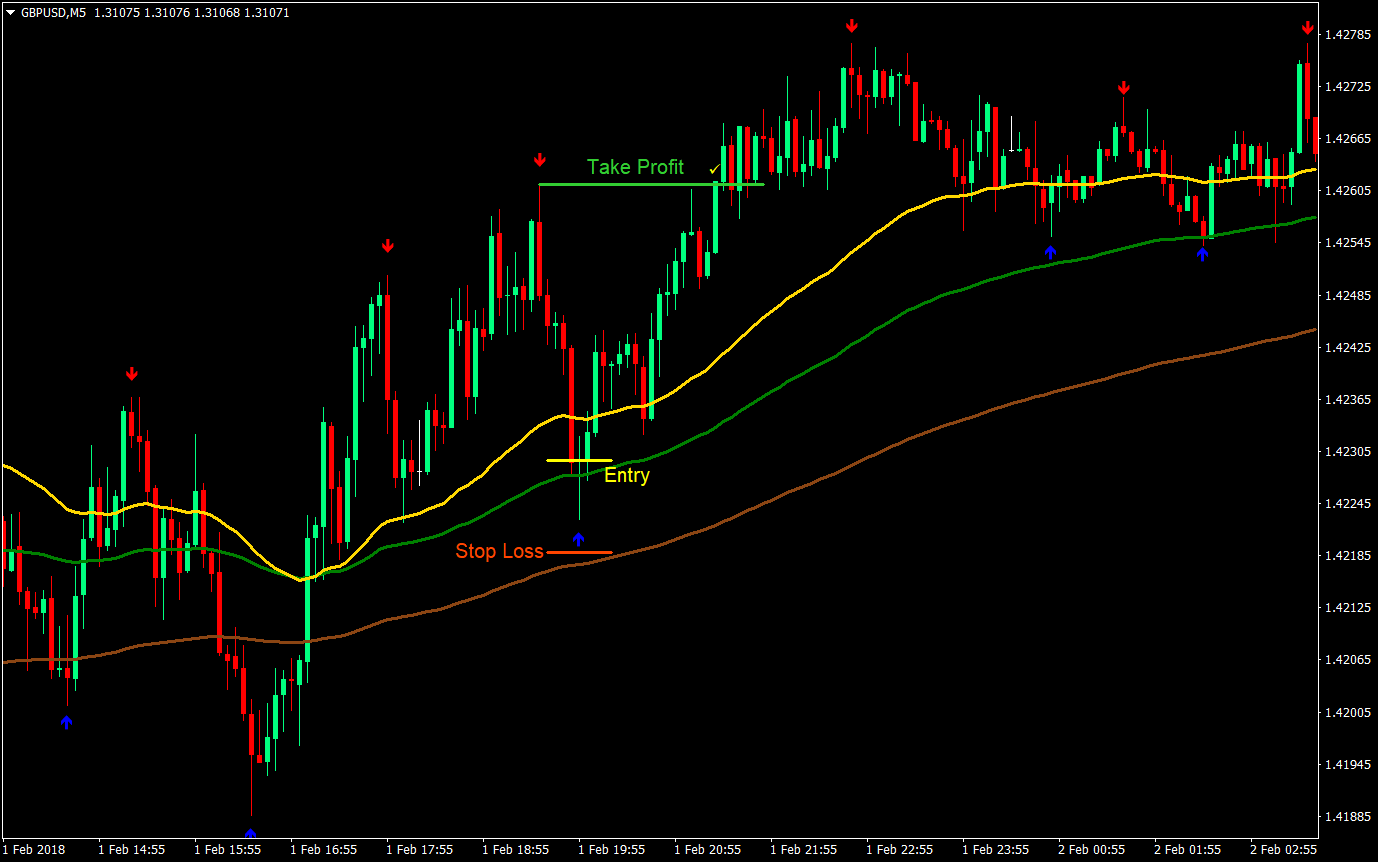

Buy (Long) Trade Setup Rules

Entry

- The moving averages should be stacked accordingly:

- 50 EMA – top

- 100 EMA – middle

- 200 EMA – bottom

- Price should retrace towards the area of the 50 or 100 EMA

- A blue binaryarrow pointing up should appear

- The candle corresponding the blue binaryarrow should be a pin bar candle with wicks at the bottom

- Enter a buy market order at the confluence of the above rules

Stop Loss

- Set the stop loss a few pips below the blue binaryarrow

Take Profit

- Set the take profit target at the most recent swing high usually corresponding a red binaryarrow

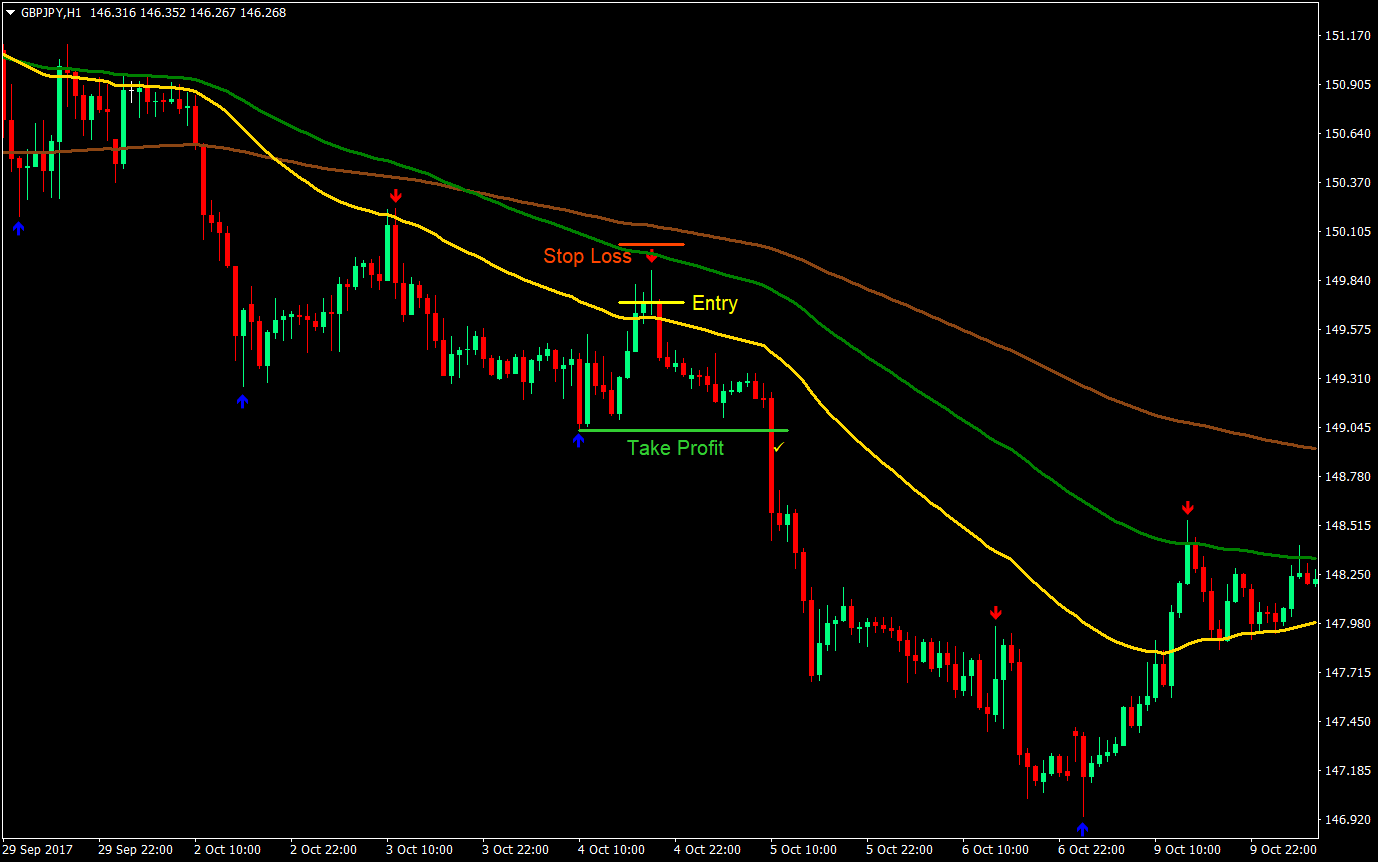

Sell (Short) Trade Setup Rules

Entry

- The moving averages should be stacked accordingly:

- 200 EMA – top

- 100 EMA – middle

- 50 EMA – bottom

- Price should retrace towards the area of the 50 or 100 EMA

- A red binaryarrow pointing down should appear

- The candle corresponding the red binaryarrow should be a pin bar candle with wicks at the top

- Enter a sell market order at the confluence of the above rules

Stop Loss

- Set the stop loss a few pips above the red binaryarrow

Take Profit

- Set the take profit target at the most recent swing low usually corresponding a blue binaryarrow

Conclusion

Trading using the 50, 100 and 200 EMAs or other configurations with the same idea is already a high probability trade strategy in itself. This is because the mid and long-term moving averages are in agreement and hence there is less resistance for price to go against and a strong force is pushing from behind price.

Getting the trade direction right using this type of strategy is quite easy. Often, you would find that price would be going your direction if you’d give it some time, unless if the entry is already towards the end of the trend and could be reversing. Where most traders fail is with the exact entry. This is where the binaryarrows custom indicator and pin bar pattern comes in. It tries to pinpoint entries and should assist traders in making decisions. It is not perfect, but it works.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: