34 EMA and Price Action Crossover Forex Trading Strategy

Moving averages, you may be hearing a lot about it. But you may also be wondering how it could be used in a strategy. Well, there are many ways moving averages could be used. It could be used as an indication of trend, as a dynamic support, etc. Different forex strategies, different perspectives, some work, some don’t, each to his own.

But one of the ways that moving averages could be used is with a crossover. Remember, moving averages could be used to detect the direction of a trend, right? So, if moving averages could be used to indicated trend, then it could also be used to indicate a reversal of a trend.

So, how do we detect a probable reversal of a trend? Simple, through an exponential moving average crossover. Basically, what we will be looking for in this strategy is a scenario wherein price action crosses-over the 34 exponential moving average (EMA). This signifies the end of the previous trend, and a probable start of a new trend. If we catch those types of reversals and can ride out the new trend, we could be cashing-in a whole lot of pips.

The Timeframes

Based on my observation, markets tend to present more trend reversals in the lower timeframes. Yes, longer timeframes also do have trends, however, due to the nature of longer timeframes, trends take longer to reverse. Thus, lesser opportunities are presented within a period as compared to the lower timeframes.

For this strategy, we will be using the 5-minute and 15-minute charts. This could be either a scalping or day trading type of strategy.

I would warn however not to use this strategy on the 1-minute chart. Why? Because the 1-minute charts are quite tricky. For one, the trader must be able to decide quickly. And even if the trader develops that quick decision-making skill, fake-outs are too many to count on the 1-minute chart. This is because even a move of just a few pips could form a long candle in the 1-minute chart, which causes confusion for many traders.

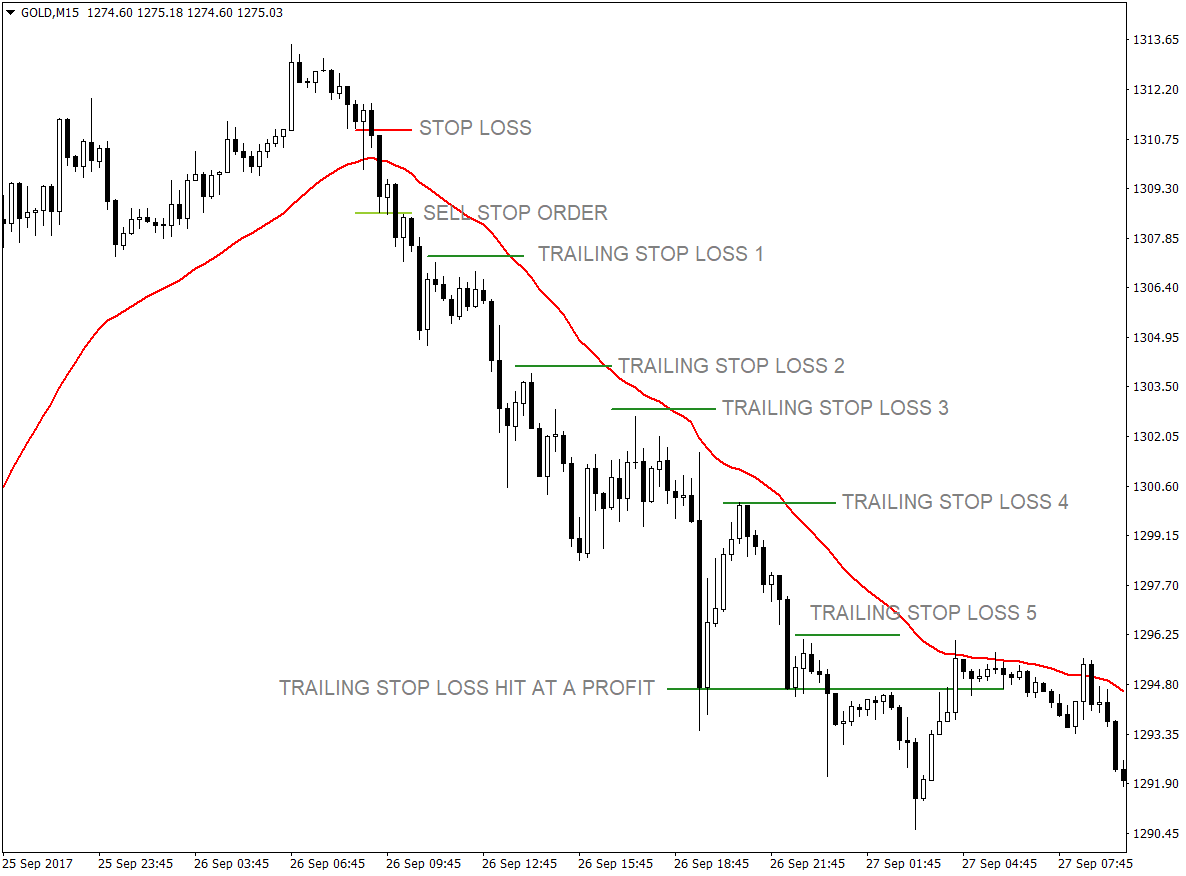

The Short Setup Rules – Entry and Stop Loss

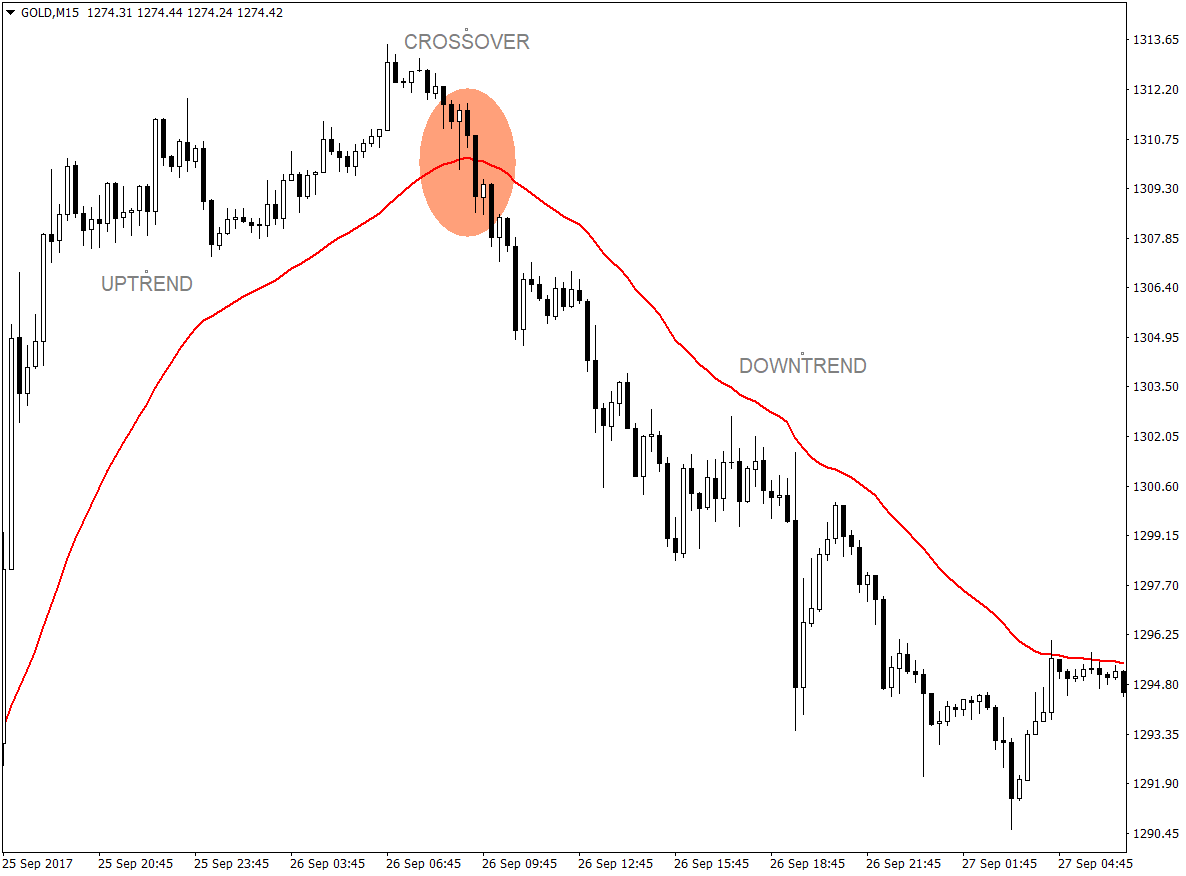

The entry will be based on crossovers. First, we will be looking for an extended trend. This means that a previous trend has been going on for quite a long time and it may be time for it to reverse. “What comes up, must come down.”

This is the type of scenario that we would want to trade. An uptrend with a very strong rally up. Market participants realized that price was too high. Then, the price action crossed-over the 34 EMA. Then the downtrend begins.

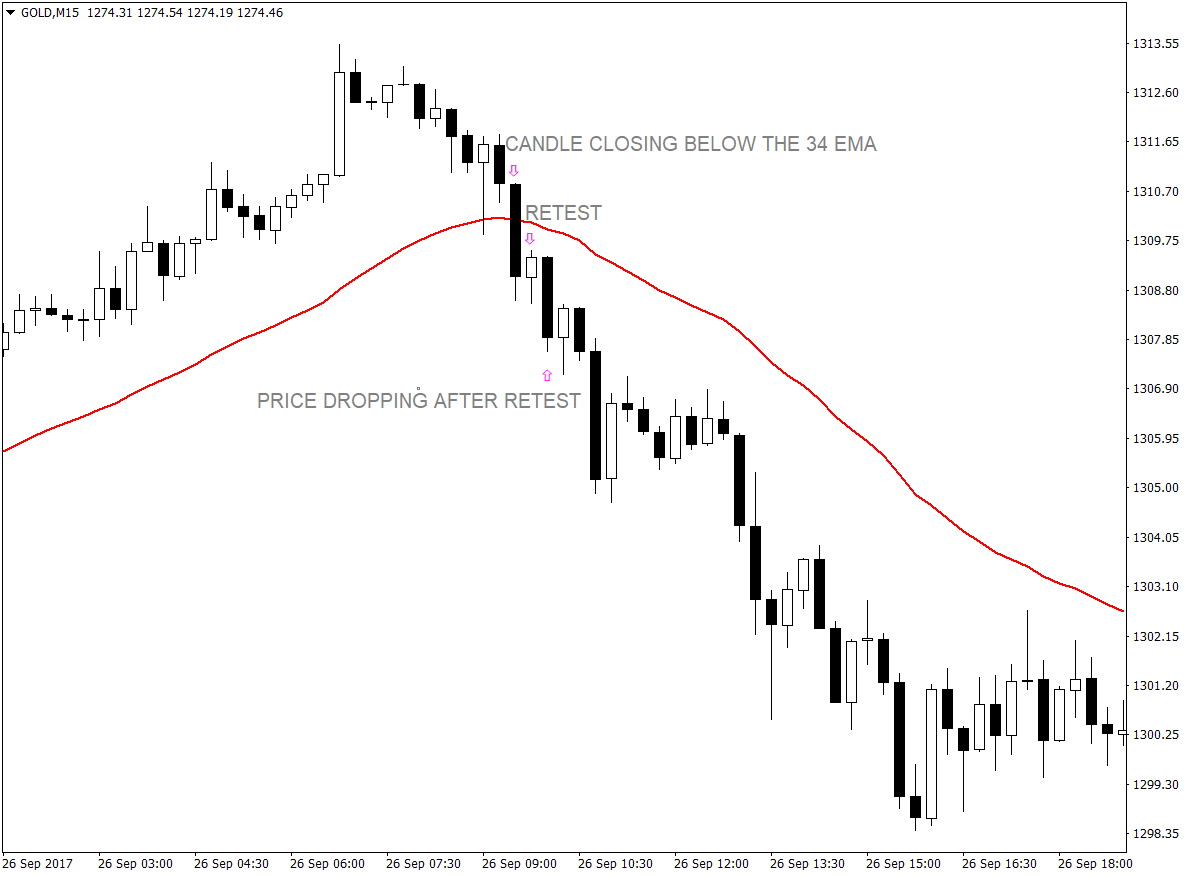

To enter the market. We should be looking for a candle to strongly close below the 34 EMA. It shouldn’t be just a touch on the 34 EMA or an indecisive close below it. Usually, price action would retest the 34 EMA as support before continuing down.

To trade this, we will be placing a Sell Stop Order right below the candle that closed below the 34 EMA. As soon as the sell stop order is hit, then we are in the trade.

As for the stop loss, it should be a few pips above the signal candle, which would naturally be above the 34 EMA. Remember, the 34 EMA is also considered as a dynamic support. This means that if the trend really does reverse, then price shouldn’t be going back above the 34 EMA.

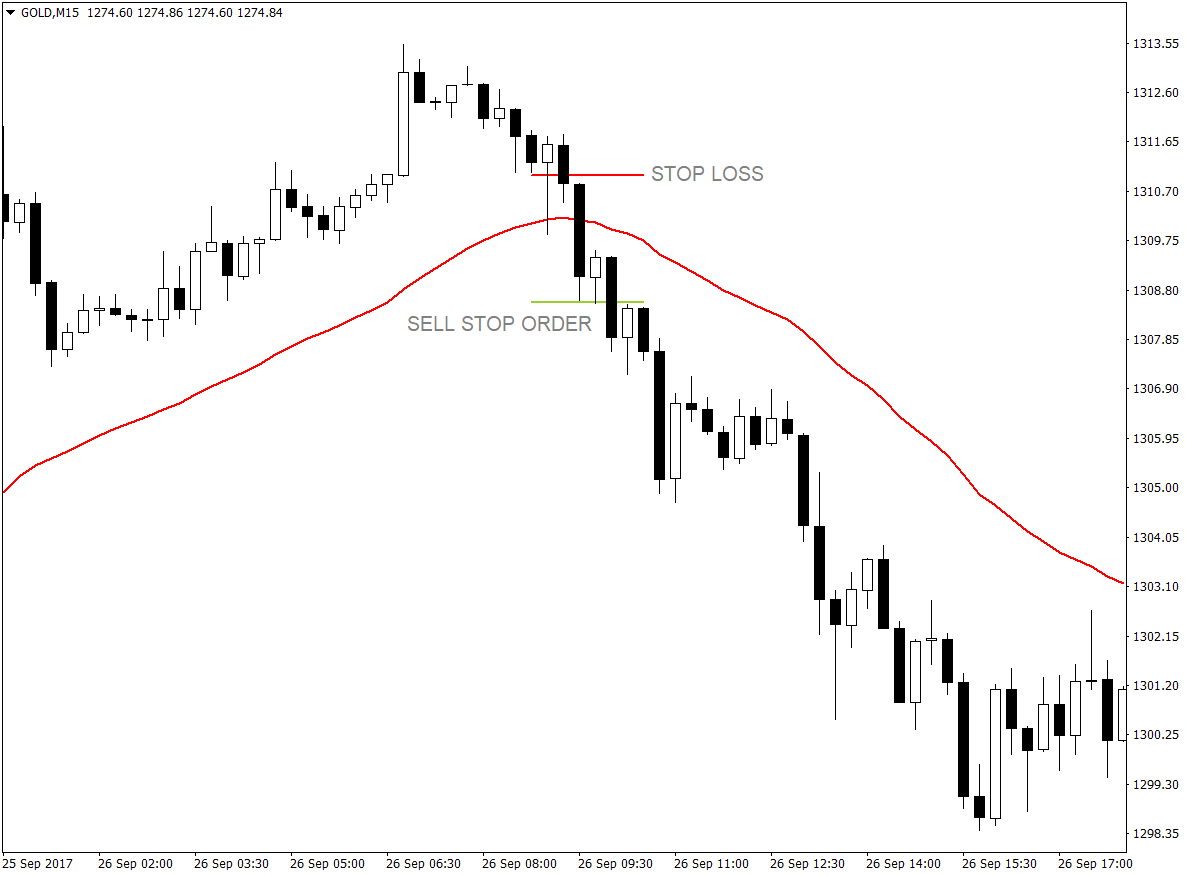

Trailing Stop Loss for Maximum Profit

Since we are banking on the assumption that the trend would reverse, we will try to ride out the trade. To do this, we will be using a trailing stop loss. Trailing stop losses are to be placed on minor lower-highs formed by minor price retracements as price continues down.

This trade was stopped out at a profit of 139 pips, while risking only 24 pips on the stop loss. That is a risk-reward ratio of more than 5:1.

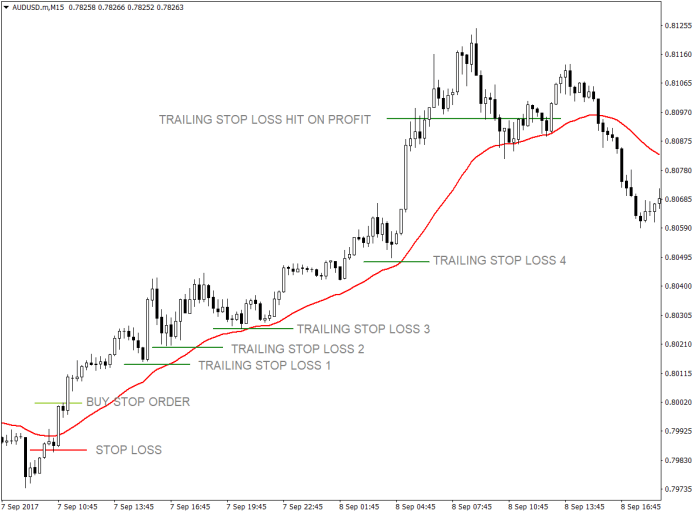

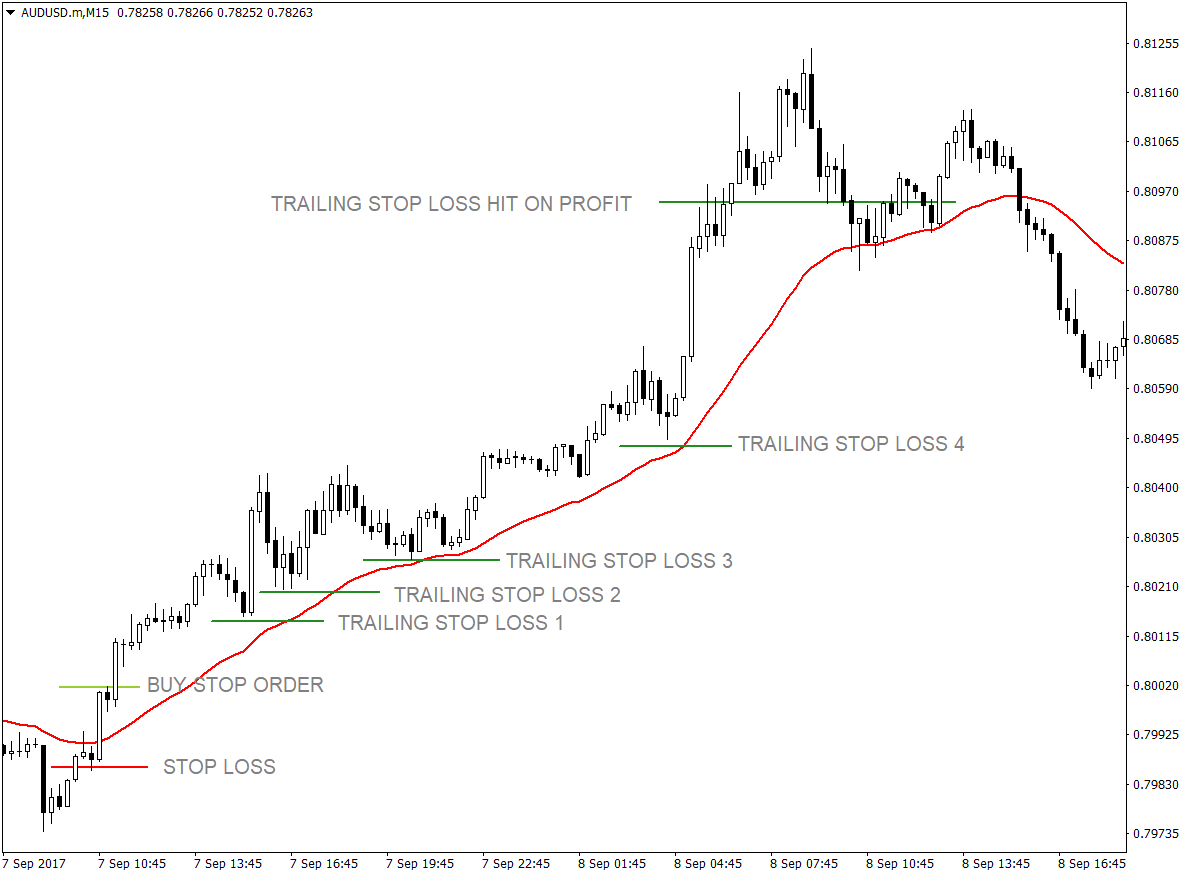

The Buy Setup – Entry, Stop Loss & Exit

As for the buy setup, everything would just be the reverse of the sell setup. Again, we will be looking for price to strongly close above the 34 EMA. Price action would then tend to retest the 34 EMA. To enter the trade, again, we will be using a buy stop order.

The stop loss should also be placed just a few pips below the entry candle and below the 34 EMA.

Lastly, trailing stop losses should also be placed on the higher-lows formed on price retracements, as price continues to push upward.

If this trade was taken, it would have gained 93 pips on this uptrend, while the stop loss is just for 16 pips. Again, that would have been roughly around 5:1 risk-reward ratio.

Conclusion

Using the 34 EMA to catch a trend reversal early on allows the trader to gain so much pips compared the risk placed on the stop loss. This allows for a very high risk-reward ratio, which is a very important aspect in trading as it allows the trader to cover for the losses of the losing trades. A risk-reward ratio of 5:1 allows the trader to cover all the losses of five losing trades.

However, trading trend reversals also have risks. There are times when after a trend, price enters a ranging market. Watch out for whipsaws, which are tell-tale signs of a ranging market. In these scenarios, this strategy shouldn’t be used. Another range trading strategy should be employed.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: