3 EMA Trend Catcher Day Trade Forex Trading Strategy

Crossover strategies are quite popular among traders. It is simple, easy to follow, and mechanical making it suitable for any trader even if you are just starting out. This may be the reason why crossover strategies are very popular.

The idea behind crossover strategies is to catch a trend right from the start and ride it until the end. This should yield a very high reward-risk ratio. The kind of trades that could make a trader’s year go from just barely making it to exponentially increasing profits.

However, a high reward-risk ratio is not the only component of a winning strategy. The other wheel that makes trading strategies run is the win-loss ratio or win rate. This is the Achilles’ heel of most crossover strategies.

Most crossover strategies would work well during a trending market or a market that immediately starts to trend whenever it reverses. But not all market conditions are like that. At times, as the market end one trend it first starts to range before it starts to either continue its trend or trend on the opposite direction. It is during these ranging and choppy markets where crossover strategies start to fail. During these market conditions crossover strategies would give a lot of entry setups and get stopped out often. Too often that even a big win couldn’t cover for the losses due to the sheer number of losing trades. During ranging markets, statistics on these types of strategies would show a high reward-risk ratio but also a low win-loss ratio. It would be fine if the profits of winning trades could cover for the losses but sometimes the wins just can’t cope with the losses. I have a trader friend in one of the chatgroups I joined when I first started trading blow up his account using a crossover strategy. It may be one of those strategies where the wins just can’t cope for the losses.

With this in mind, crossover strategies shouldn’t be used as the only strategy traded in all market conditions. This would definitely fail during ranging and choppy markets. To make a crossover strategy work, it should be used just as the market starts to trend and then let it run until the trend is fully exhausted.

The Setup: Trading the 3 EMA Crossover Strategy

The idea behind this strategy is to catch a trend just as it is starting to run and then ride the whole trend until the end. But not all crossovers will trend, so we will filter out crossovers that still has no indication of trending.

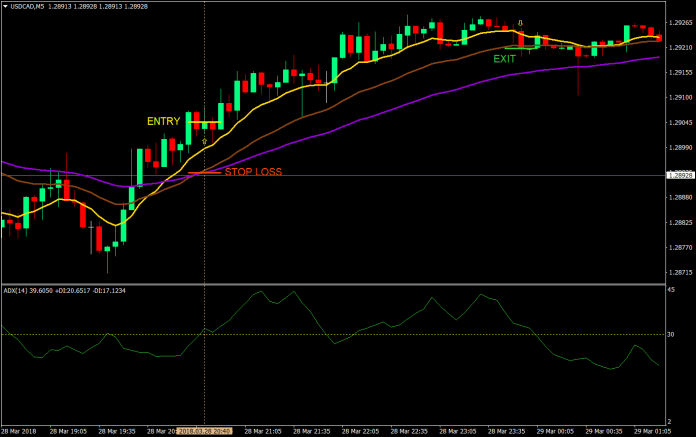

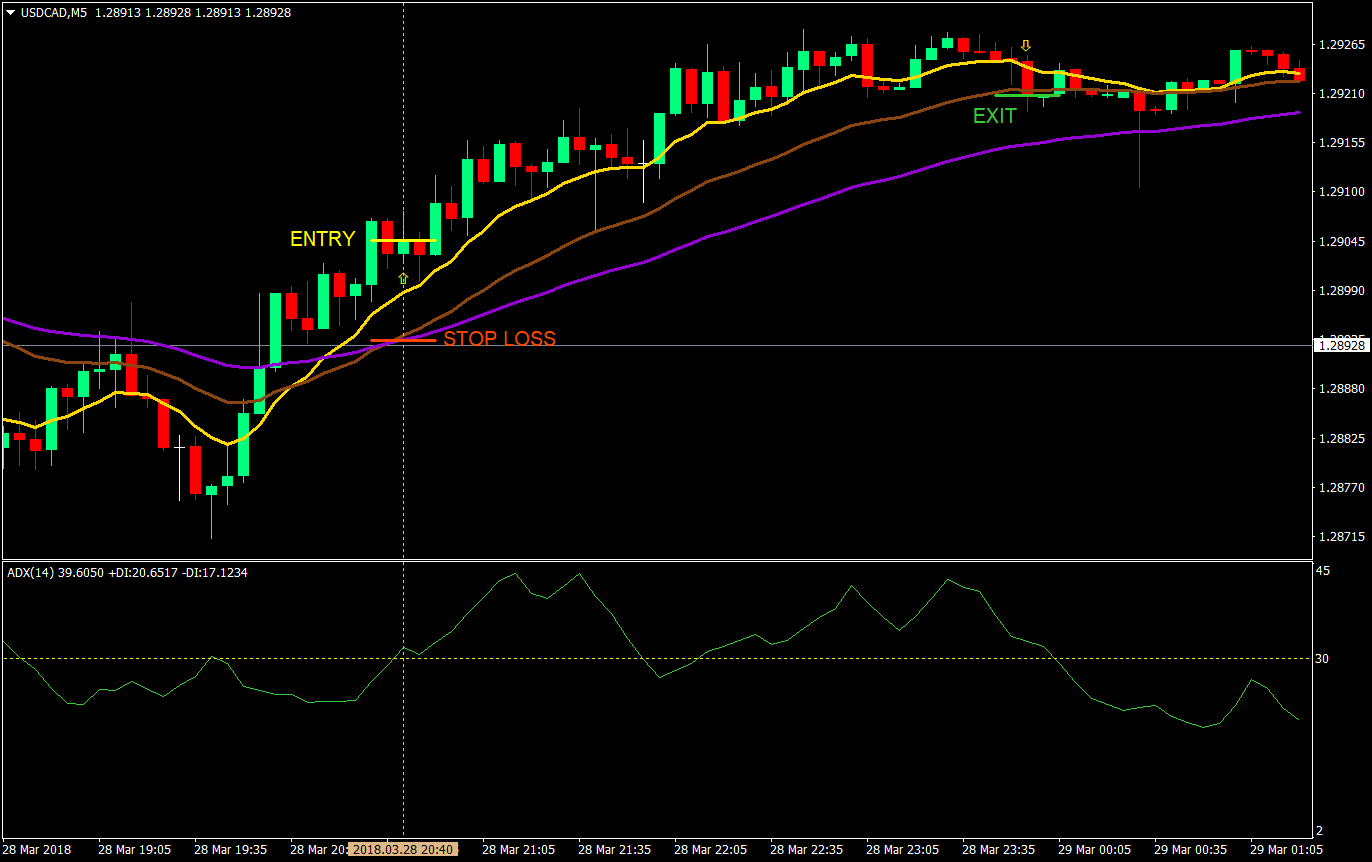

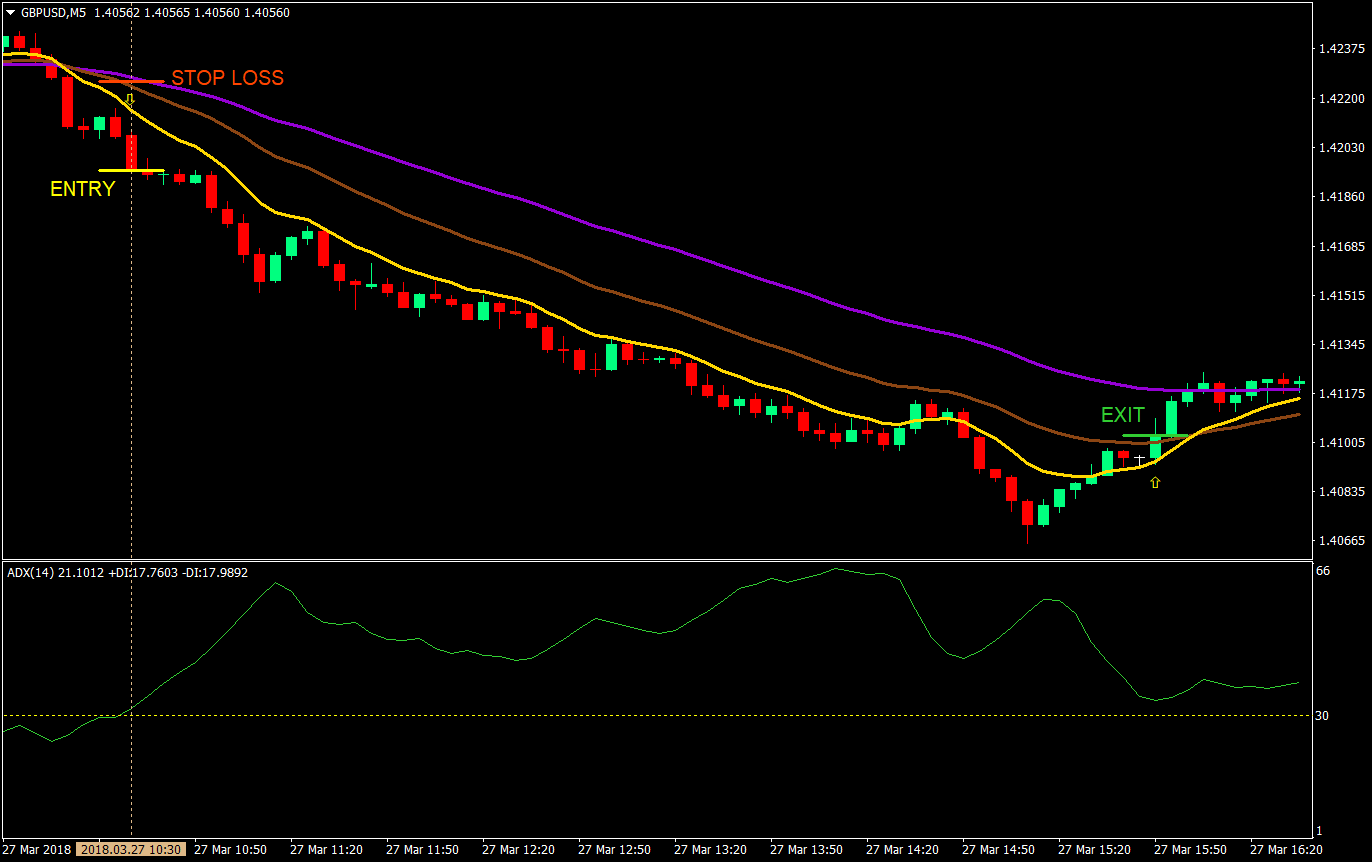

To start with, we will be using the 50 exponential moving average (EMA) as our main directional bias moving average. Our fast moving average will be the 10 EMA. Crossovers of the 10 EMA and the 50 EMA will be our main entry signals.

Our third moving average will be the 25 EMA. This will be used for our exit strategy using a trailing stop loss. This should allow us to catch a big chunk of the trend.

But not all signals generated by the 10 & 50 EMA should be taken. This will be a recipe for disaster if done during a ranging market. To filter out ranging market conditions, we will be using the Average Directional Movement Index (ADX). This indicator is mainly used to identify if a market is ranging. This indicator is not perfect, but it should lessen entries taken during a ranging and choppy market.

Since this is a day trade strategy, we will be using the 5-minute chart. Many traders use the 5-minute chart to scalp, but since we are trying to catch and ride the whole trend, we will be in the market quite longer, good enough to do day trades on.

Buy Entry:

- The 10 EMA (gold) should cross above the 50 EMA (violet)

- The ADX should be above 30

- Enter at the close of the candle

Stop Loss: Set the stop loss below the 25 EMA (brown)

Exit: Trail the stop loss below the 25 EMA until stopped out in profit

Sell Entry:

- The 10 EMA (gold) should cross below the 50 EMA (violet)

- The ADX should be above 30

- Enter at the close of the candle

Stop Loss: Set the stop loss above the 25 EMA (brown)

Exit: Trail the stop loss above the 25 EMA until stopped out in profit

Conclusion

Although this strategy is classified as a crossover strategy, it is something that shouldn’t be written off immediately. The difference between this strategy compared to most crossover strategies is the ADX filter. By using the ADX and entering the trade just as the ADX goes above 30 means we are entering the trade near the beginning of the trend. Yes, we haven’t caught the start of the trend by waiting for the ADX instead of entering at the 10 & 50 EMA crossover, but the advantage to this is that we are avoiding whipsaws and ranging markets.

Although this strategy should filter out many of the choppy markets, it is still not perfect. There will be entries that would not trend but instead will start to reverse. Other times, the ADX will dive back below 30 and start to chop. However, these scenarios will be lessened.

This strategy’s use of the 25 EMA as a stop loss right from the beginning of the trade leans towards the conservative side. This stop loss setup is quite wide, but it should allow your trade to breathe a little. The space between the 10 & 25 EMA will be considered as a dynamic area of support or resistance. This means price could still retrace in between those two EMAs before bouncing off going the direction of our trade. We wouldn’t want to have our stop loss hit only to find that our trade direction was right.

However, for those who would want to increase their reward-risk ratio could set the initial stop loss a little bit closer, then trail the stop loss behind the 25 EMA as soon as the trailing stop is in profit. This should increase the reward-risk ratio but there will be times when the stop loss will be prematurely hit.

Recommended MT4 Broker

- Free $50 To Start Trading Instantly! (Withdrawable Profit)

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Award Winning Forex Broker

- Additional Exclusive Bonuses Throughout The Year

>> Claim Your $50 Bonus Here <<

Click here below to download: